Fintech Centre of Excellence at NSRCEL, in partnership with HDFC Parivartan–the CSR arm of HDFC Bank is calling on startups who are expanding access to banking, strengthening financial inclusion, and solving meaningful financial challenges for different sections of populations.

If your solution leverages technology to simplify banking, payments, credit, savings, or financial literacy, this is your opportunity to accelerate your impact.

Program Highlights

Access to Sandbox & Regulatory Connects

Founders work toward regulatory market fit – with support on navigating compliance, decoding early policy signals, and accessing relevant regulatory sandboxes when needed.

1:1 Sessions with Industry Experts

1:1 sessions with founders, fin-experts and functional experts who address helping you stress-test your GTM roadmap, fix what’s stuck, and move faster.

Investment Readiness

We plug you into the right investor conversations – based on your sector, traction, and timing. Includes narrative sharpening, round structure advisory, and strategic feedback from angels, VCs, and corporate venture arms who understand fintech depth.

Access to Partnership Connects

Opportunities to engage with banks and corporates who can serve as strategic partners or potential customers for pilots, distribution, or co-development.

Program Eligibility

To be part of this exclusive program, you must:

Fintech & Allied Areas

Revenue Generating, must have existing customer base

Raised Seed round or come recommended by your investor

Existing Customer Base

Sectors In Focus

Core Financial Services

- Payments & Transfers

- Lending & Credit (incl. BNPL, Co-lending, Embedded Credit)

- WealthTech (Robo-Advisory, Portfolio Tools)

- Neo-Banking & Digital Banking

- Personal Finance & Budgeting Tools

- Insurance and Insurtech Platforms & Integrations

Risk, Compliance & Infra

- Regulatory Technology (RegTech)

- Credit Intelligence & Underwriting Tools

- Digital KYC & Fraud Detection

- Core Financial Infrastructure (AA, UPI stack, API gateways)

- Risk Management Platforms

Inclusion & Sustainability

- Financial Inclusion (last-mile, vernacular, gender-focused)

- Green Finance / ESG-linked Finance

- Microinsurance & Healthtech-Insurtech blends

- MSME-focused Lending or Platforms

Tech-Driven Enablers

- AI/ML for Financial Services

- Blockchain / DLT in Fintech

- Data-as-a-Service & Financial APIs

- Cybersecurity & Identity Tech

Verticalized & Integrated Fintech

- Agri-fintech

- Mobility Finance

- Healthcare & Edu-finance

- Supply Chain & Logistics Fintech

- Real Estate & Construction Finance

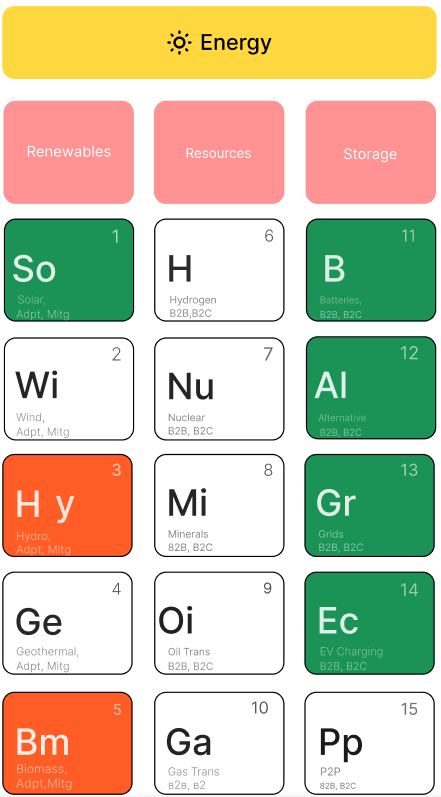

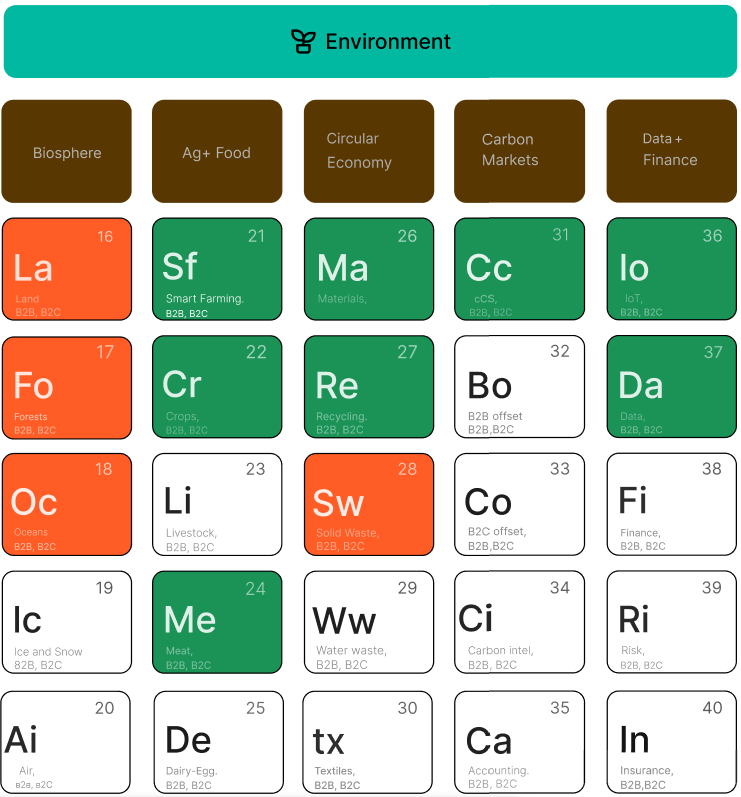

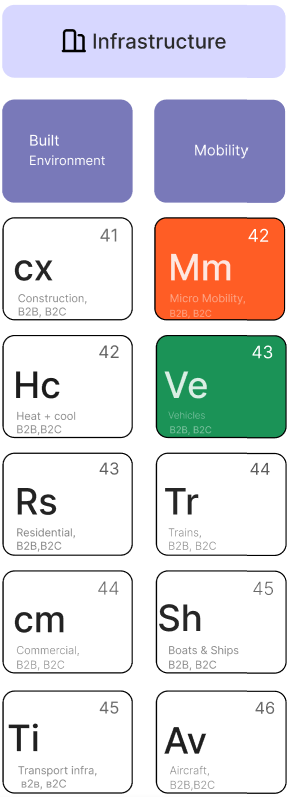

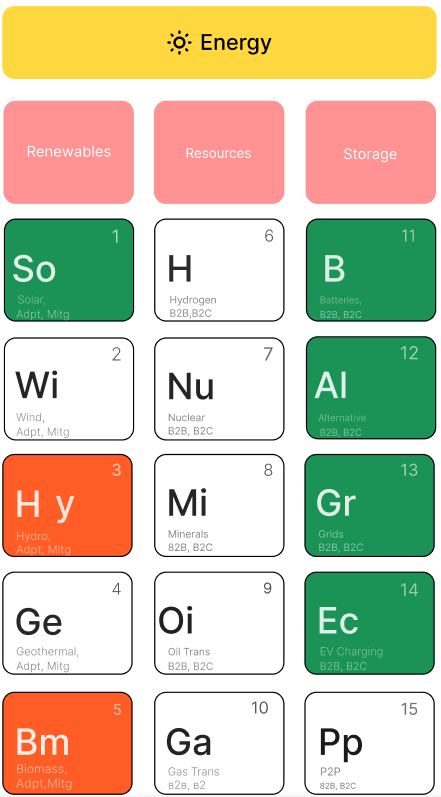

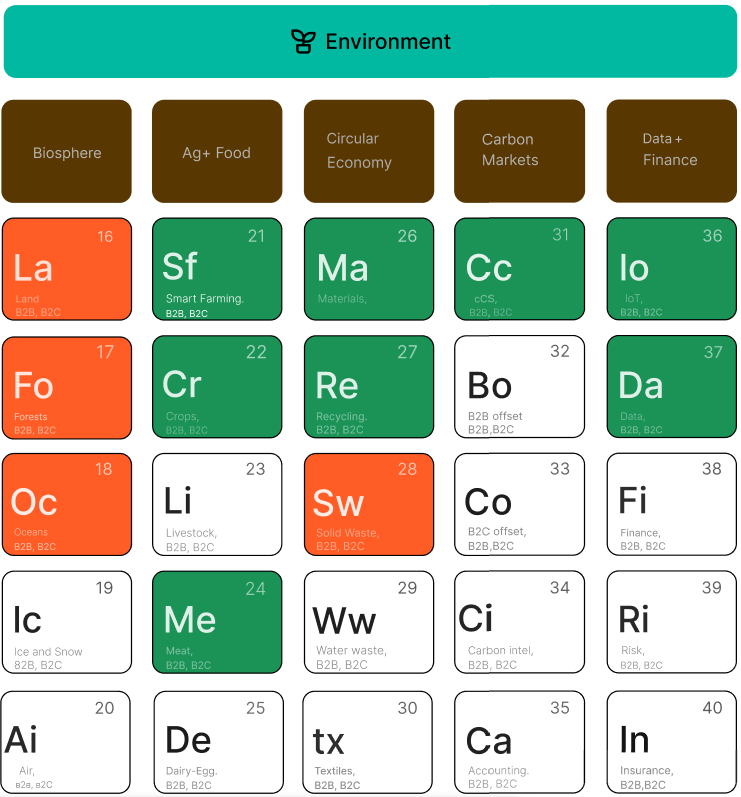

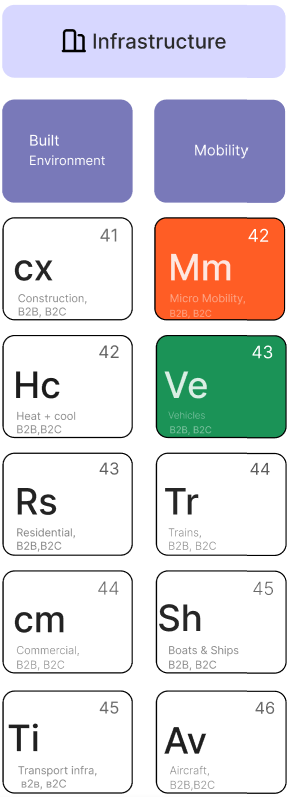

Our Incubation Thesis:

Catalyse Innovation in these areas

Source: Global Climate Tech Landscape

- HIgh Potential Sectors

- Growing Potential Sectors

- Emerging Sectors

Stakeholders

Inside the Room

- Meet the Startups

Bimakavach Technologies Private Limited

Finsall Resources Private Limited

Inka Insurance

Xaults Technologies Private Limited

Maximize Pay Solutions Pvt Ltd

PensionBox

Fundfina

Mysa

BoxPay Technologies Pvt Ltd

Dhiway Networks Private Limited

Rang De P2P Financial Services Ltd

Multipl

Saventh

Butter Money

Lark Finserv Private Limited

Boharr Fintech Private Limited

Clevernav

Covrzy

Komplai

Signalz By Katalx Technologies Private Limited

Castler (Ncome Tech Solutions Pvt Ltd)

Indniveza Distributors Private Limited

Ablecredit

Nullpointer Analytics Private Limited

Community

Tap into networks, exchange ideas, and gain practical guidance that’ll help you increase your surface area of success. The community is built to meet you where you are, and grow with you.

Join the Fintech Circuit

Excecution Parnters

- Funding Partners

- Knowledge Partners

- Partners Building with Us

Co-Incubation Partner

IIMBx Fintech Skilling Program

A curated learning and skilling platform by IIMB faculty and industry experts for those looking to build depth in fintech. The program combines conceptual grounding with practical insights, supported by assessments along the way.

Frequently Asked Questions

Who is eligible to apply?

Tech / Tech-enabled Ventures: ventures that leverage technology or are tech-enabled.

MVP ready: Must have a fully developed product that’s ready to go to market.

Traction: Should already have some traction in the areas of Customers, user base or product offering.

Location: Indian Startup

Sector: Fintech and allied areas

I have applied in the past for a different program. Can I apply again?

Sure, but to improve your chances of selection, do highlight additional information on the progress you have made since your previous application.

When can I apply?

You can register your interest throughout the year. Applications are live now.

What does NSRCEL expect from you?

We expect you to be an active participant in all the efforts we put into nurture your venture.

What is the duration of the Incubation?

The cohort lasts for 3-6 months but it does not end there, you will then be a part of our NSRCEL community

Does the program focus on specific sectors?

YES, we consider applications from only the Fintech sector.

How much does it cost to apply or participate in the program?

The program is free of cost and no equity is taken from the startups. The program is fully supported by NSRCEL.

Does the program focus on specific geographies?

We consider applications from across all geographies registered in India.

My question is not answered here, where can i reach out?

You can reach out to us at fintech.coe@nsrcel.iimb.ac.in